🏧 Chime's "Get your Deposit up to 2 Days Early" Strategy

Case Study. 5 minute read. 7 minute listen (if you want to hear my beautiful voice)

What is Chime❓

Chime is a financial technology company whose mission is to “unite everyday people to unlock their financial progress”. They partnered with national banks, The Bancorp Bank N.A. and Stride Bank N.A. to grow this mission.

It prides itself on helping its customers to be financially stable through the products and services it offers. The problem Chime was built to solve is a bank that works for everyday people. Traditional financial institutions seek to exploit everyday people through their business models of excessive fees, predatory products/services, and high interest credit cards. Chime saw to minimize these expenses so that everyday people have a bank that works with them not against them.

Chime’s business model

Chime rely on interchange fees which is the fee merchants (businesses) pay to facilitate a transaction with customer’s card payments. They are basically charging the business to interact with their customers.

Since Chime is an online bank it does not rely on any over head costs that retail banks have. It can focus on building the most compelling products and services that help aid in their mission of uniting everyday people with progressing financially.

Snapshot of Chime 📸

San Francisco-based FinTech company

Over 20 million users and counting 👨🏽👩🏽👧🏽👦🏽

Founded in 2012 by Chris Britt and Ryan King

Ranked 4th in Customer Service Products by Newsweek

1M+ five-star reviews on Google Play and Apple’s App Store

Apple’s most downloaded banking app

Chime’s Game-Changer: Why It Works

Chime’s claim to fame? “Get your direct deposit up to two days early.” A simple, genius tagline that shook up the banking industry like an earthquake in Silicon Valley. Chime didn’t just challenge traditional banks—it humiliated them.

Why stand in line to cash your paycheck when you can skip the fees, the waiting, and the stress? Chime offered a modern, fee-free approach to banking, targeting people who were sick of being nickel-and-dimed by big banks.

Here’s how they did it:

No fees for overdraft, ATM withdrawals, or foreign transactions.*

Partnerships with real banks (Bancorp and Stride) to handle the backend.

A killer user experience.

Chime isn’t a bank—it’s a rebellion. A digital Robin Hood, cutting out fees and giving people their own money back.

Banking, Then and Now 🏦

Remember when you had to cash your paycheck at a sketchy check-cashing joint? Yeah, fun times. You’d walk out clutching your cash, praying no one mugged you before you got home.

Now? Direct deposit, baby. No checks, no lines, no headaches. But here’s where Chime really changed the game: it made "early payday" the norm. That’s right—Chime brought the future two days closer.

Other banks had no choice but to follow suit. Now Chase, Bank of America, and Wells Fargo are all playing catch-up, offering early paycheck deposits like they thought of it first. Spoiler alert: they didn’t.

The FinTech Revolution

Chime isn’t alone in the FinTech world, but it’s leading the charge. Alongside giants like PayPal, Stripe, and Cash App, Chime carved out its niche as the bank for the people.

Its mission? Empower everyday folks to achieve financial progress. And it’s not just lip service. Chime actually doesstuff:

Caps overdraft fees at $200 (because life happens).

No monthly fees or minimum balances (because your money should work for you).

Offers tools to build credit (because everyone deserves a shot at financial stability).

Chime isn’t just selling banking services; it’s selling hope. And that’s a damn good business model.

Innovation for the People 🦸🏼

One of Chime’s latest features, MyPay, lets users access up to $500 of their paycheck at any time. It’s not a groundbreaking idea, but it’s a thoughtful addition that cements Chime’s reputation as the bank that actually cares.

On top of that, Chime started the Chime Scholars Foundation, a nonprofit funding higher education. Because nothing says “financial progress” like giving people the tools to succeed.

Chime was founded with the underlying belief that everyone should have the ability to create a better future for themselves.

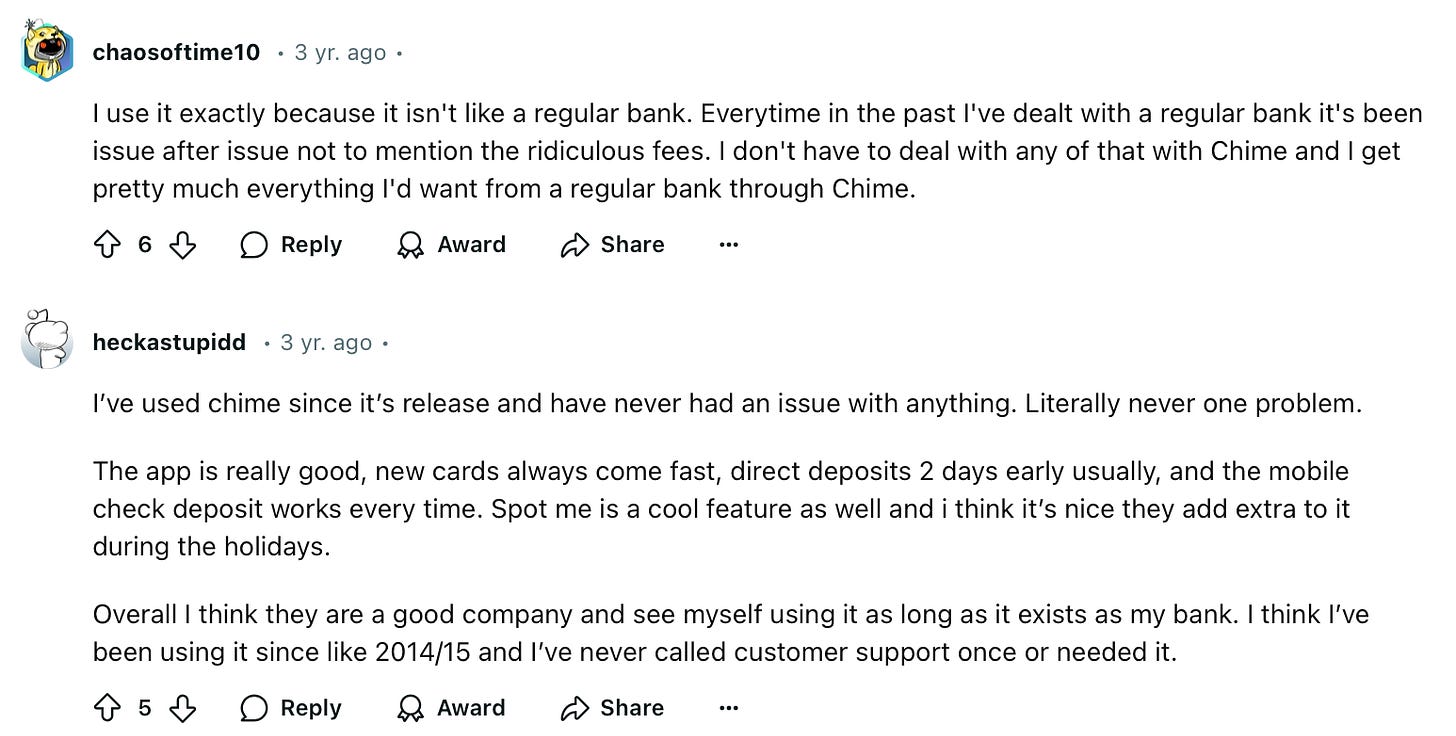

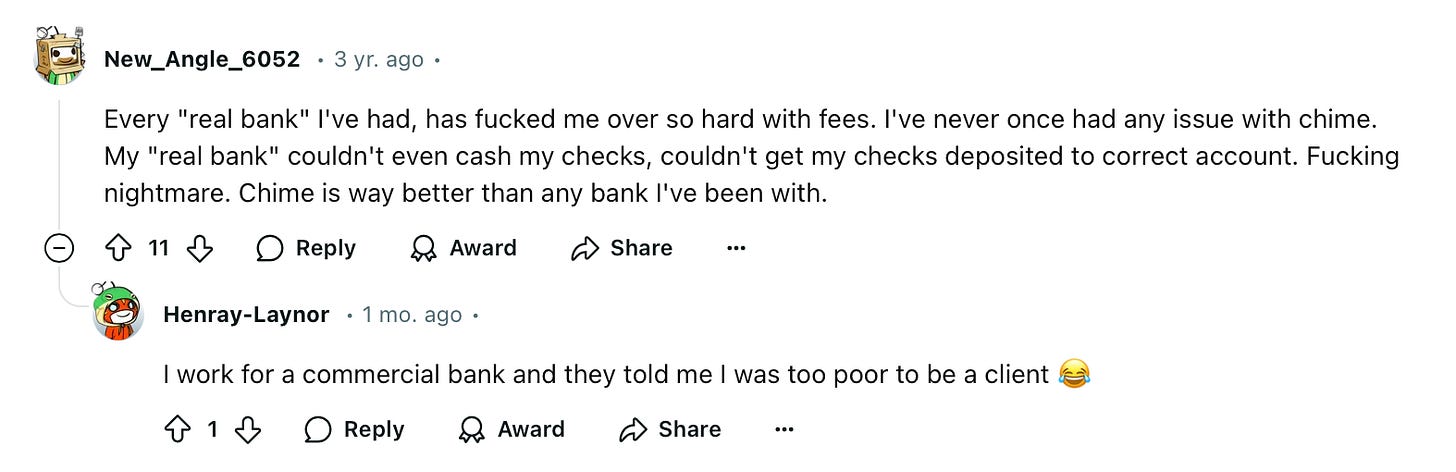

The Old Guards: Struggling to Keep Up

Traditional banks have been caught flat-footed. For decades, they’ve relied on bloated fees and outdated systems to stay afloat. But Chime flipped the script.

Instead of punishing customers, Chime made banking easy, convenient, and (gasp!) human. Big banks like Wells Fargo and Bank of America are finally starting to pay attention. Why? Because Chime is eating their lunch.

The lesson here is simple: adapt or die. The old guards can either change their ways or watch customers flock to modern alternatives like Chime.

The Bottom Line

Chime didn’t just create a banking app; it created a movement. It made people feel seen, valued, and empowered. And if Chime keeps putting customers first, there’s no limit to its potential.

The moment it veers off course, though? That’s when the Robin Hood act crumbles. For now, Chime is the hero we didn’t know we needed—and the kick in the ass that traditional banks desperately deserved.

Who doesn’t want to get paid early? Well with Chime this is what they sold themselves on…and it worked very well !

Resources

*There are some limitation to these fees such as the overdraft fee where your capped at $200 to overdraft on before a fee is charged